Recording Inventory Journal Entries in Your Books Examples

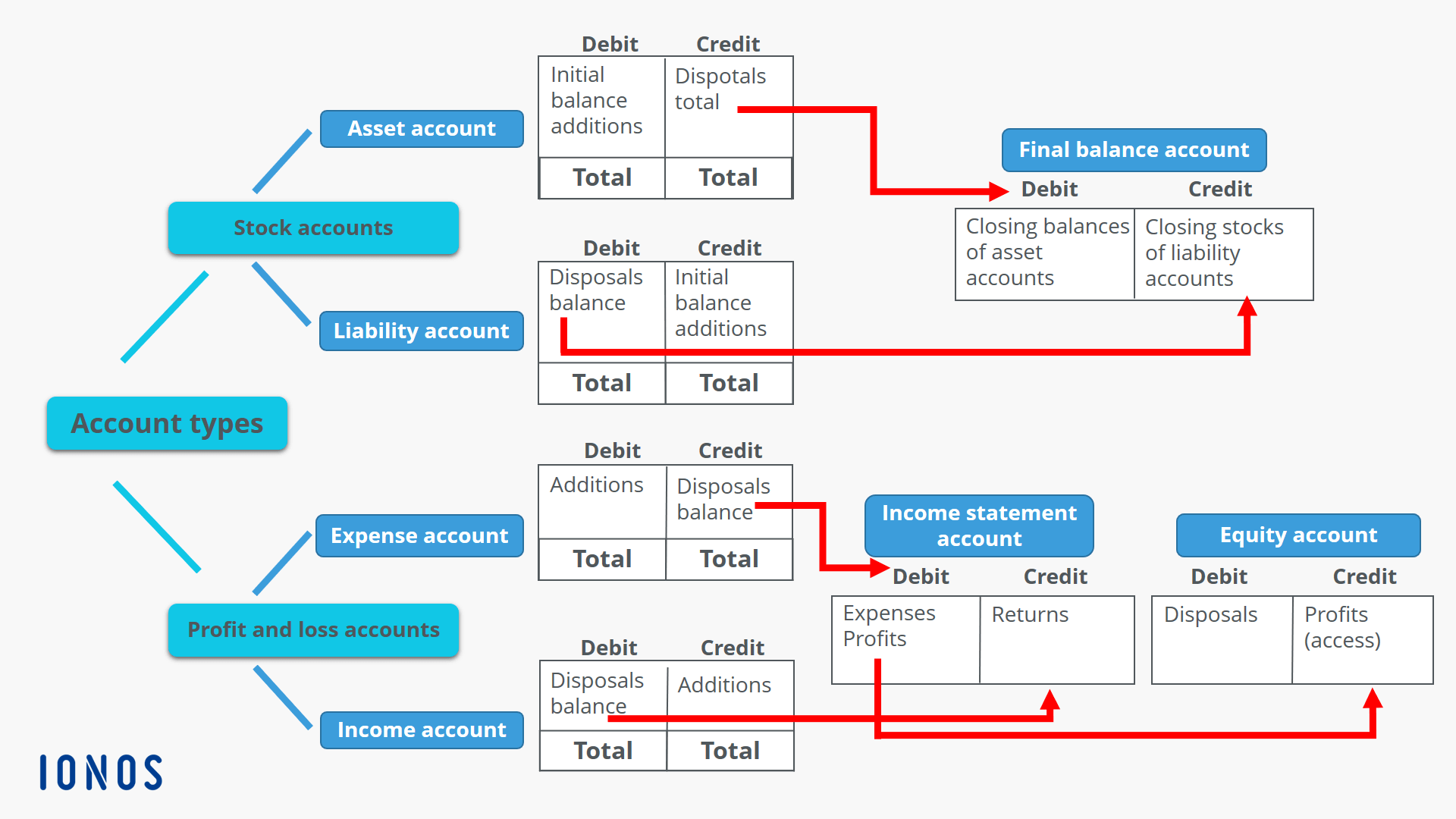

Balance sheet and income statement accounts are a mix of debits and credits. While “debit” and “credit” may evoke thoughts of everyday banking products like debit and credit cards, their role is more sophisticated in accounting. The perpetual vs periodic inventory system journal entries diagram used in this tutorial is available for download in PDF format by following the link below. To correct an overage, increase (D) the balance on the Inventory object code and reduce (C) the Inventory Over/Short object code in the sales operating account. To correct a shortage, reduce (C) the balance on the Inventory object code and increase (D) the Inventory Over/Short object code in the sales operating account.

Record Finished Goods

- Many business owners will use accounting software to help them track and calculate financial information, including inventory management and accounting.

- The total of your debit entries should always equal the total of your credit entries on a trial balance.

- You’ll list an explanation below the journal entry so that you can quickly determine the purpose of the entry.

- For that reason, we’re going to simplify things by digging into what debits and credits are in accounting terms.

- As such, your account gets debited every time you use a debit or credit card to buy something.

- Inventory can be both a debit or credit depending on the situation and how it’s being accounted for.

The information discussed here can help you post debits and credits faster, and avoid errors. A balance sheet reports your firm’s assets, liabilities, and equity as of a specific date. She will need to use the weighted average costing method to determine the cost of units sold. Lisa calculates this number by taking the total inventory purchased in the year, $1250, dividing it by the total number of lipstick units, 90. The average cost of lipstick would then be $13.89, meaning she sold 15 lipsticks at $13.89, for a total of $208.35. For example, if Mary owns a kitchenware store and uses the FIFO method, she’ll need to assign costs to her inventory based on the goods purchased first for her retail business.

What about income statement accounts: Where do debits and credits apply?

Understanding debits and credits will give you a solid accounting foundation, whether you manage your own business finances or oversee finances as a CFO. This creates an asset (accounts receivable) and increases equity through earned revenue. This increases the business’s cash (asset) and increases equity through revenue earned from the sale.

Differences between debit and credit

The transactions are listed in chronological order, by amount, accounts that are affected and in what direction those accounts are affected. This accounts for the gradual decrease in the value of a non-current asset over time. For example, a business recorded monthly equipment depreciation amounting to $400. Sal records a credit entry to his Loans Payable account (a liability) for $3,000 and debits his Cash account for the same amount.

Cash

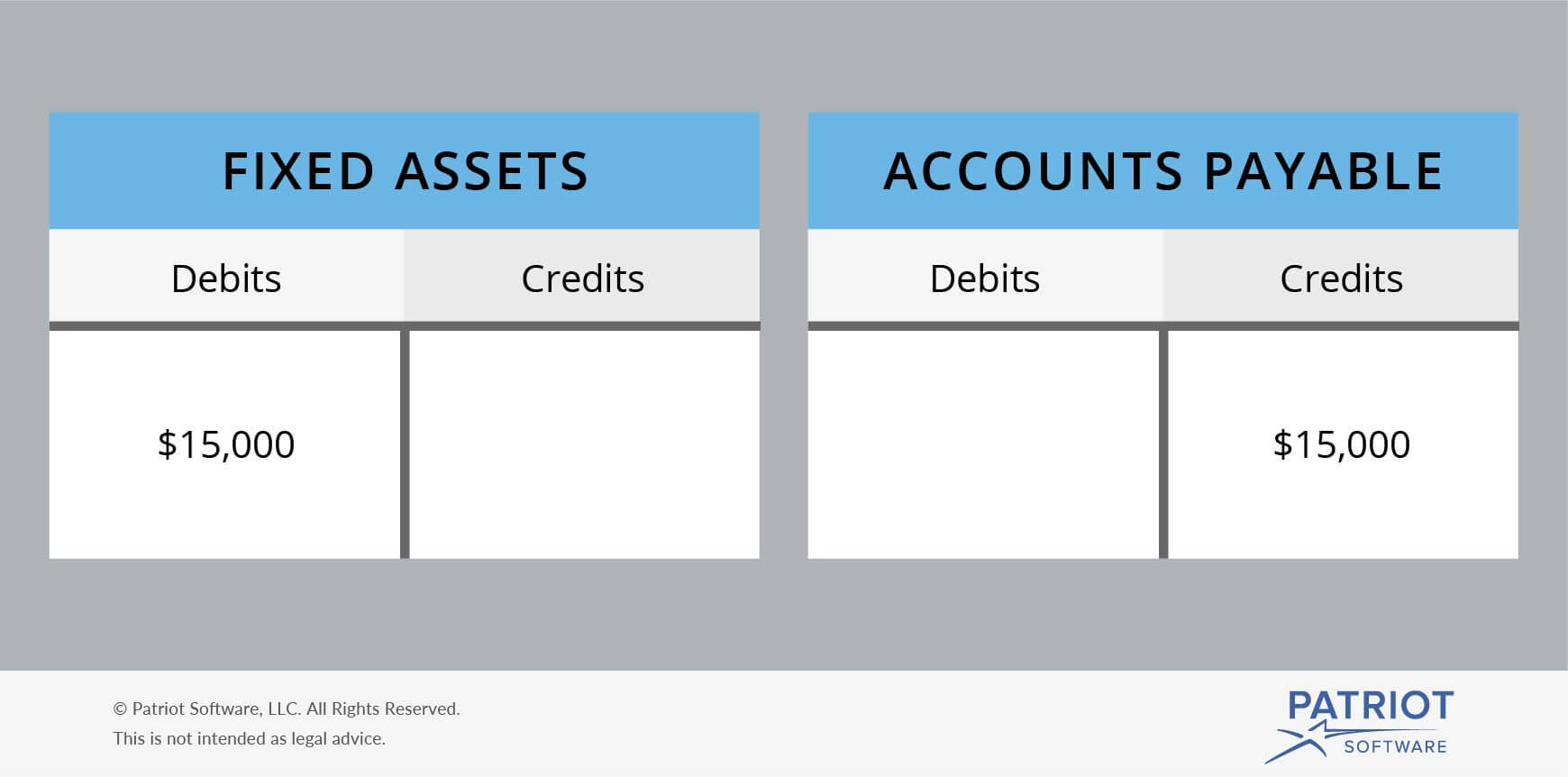

This will help ensure that all of your general ledger account balances are correct, and allow you to generate accurate financial statements that give you insight into your business finances. Double-entry bookkeeping is the foundation of accurate accounting. For every transaction, you’ll need to record both a debit and a corresponding credit in two different accounts. For example, when you buy inventory, you’ll debit your inventory account and credit your cash or accounts payable account. Ultimately, this system helps keep your books balanced and helps make sure nothing slips through the cracks.

What is a credit in accounting?

However, since the service will be provided over 12 months, the $1,200 is initially recorded as a liability (unearned revenue), reflecting the obligation to deliver the service. The company receives cash upfront but recognizes the revenue over time. Revenues are the income earned from business operations, like sales or service income. The time period for making these calculations needs to be the same. The calculations can be done weekly, monthly, quarterly, or yearly depending on the volume of your transactions; however, all transactions must be completed by June 30.

If you use credit cards, check the card issuer website frequently to review your activity. Keep an eye out for fraudulent charges and make all of your payments on time. Fortunately, federal governments have put stronger consumer protection laws in place to protect cardholders. Understanding these basic concepts can help individuals gain more insights into their finances and even better understand how businesses operate financially. As a result, the calculations for an inventory’s cost of goods sold will reflect the movement and value of the goods.

Here are some examples to help illustrate how debits and credits work for a small business. Within each, you can have multiple accounts (like Petty Cash, Accounts Receivable, and Inventory within Assets). Each sheet inventory debit or credit of paper in the folder is a transaction, which is entered as either a debit or credit. Liabilities are obligations that the company is required to pay, such as accounts payable, loans payable, and payroll taxes.

Accounting for inventories can be complicated with specific rules for debits and credits affecting various accounts. Fortunately, computerized accounting systems help in this process, minimizing errors while automatically performing many tasks. The rules for inventory accounting in the United States are governed by the Generally Accepted Accounting Principles, also known as GAAP. In each case the perpetual inventory system journal shows the debit and credit account together with a brief narrative. For a fuller explanation of journal entries, view our examples section.