2023 Budget in danger as crude output crashes by 470,000 bpd

Implementation of the 2023 budget of N21.8 trillion is currently threatened as the nation has suffered a shortfall in crude oil output, amounting to 470,000 barrels per day, bpd in August 2023.

This represents 29 per cent fall from the budget benchmark of 1.69 bpd.

At the current global market price of $92 per barrel, the 470,000 bpd shortfall amounts to a loss of $43.2 million daily or N32 billion at the Central Bank of Nigeria’s exchange rate of N742.10/$. The budget was pegged on 1.69 million bpd and $75 per barrel and at the exchange rate of N437.57/$, the government expects to generate N2.29 trillion from the oil sector in 2023.

But in its September Monthly Oil Market Report, MOMR, obtained by Vanguard, yesterday, the Organisation of Petroleum Exporting Countries, OPEC, disclosed that Nigeria produced 1.2 million bpd, excluding condensate, with output of 233,531 bpd meaning that the nation did not meet its production quota of 1.8m bpd during the period.

Crude oil theft was largely fingered as the factor responsible for the nation’s inability to meet either the budget benchmark or OPEC quota.

This is even as the Nigerian Upstream Petroleum Regulatory Commission, NUPRC, put the nation’s condensate output at 233,531 bpd (Blended and Unblended) during the period, indicating that the nation did not meet its set target.

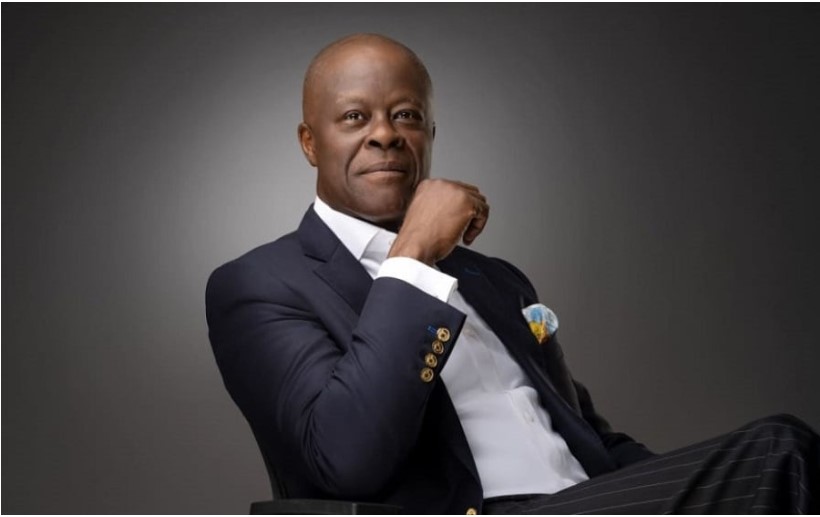

Reacting to the development yesterday, the National President, Oil and Gas Service Providers Association of Nigeria, Mazi Colman Obasi, said: “The current high crude oil prices currently standing at $92 per barrel could have reduced the negative impact of low output on the nation.

“But the nation is currently subsidising fuel import directly or indirectly as the prices of refined petroleum products have risen significantly in the global market.”

IoCs, others face sabotage, theft — Shell

Also reacting, the Country Chair of Shell Companies in Nigeria, Osagie Osunbor, who confirmed the severity of oil theft in the company’s briefing, said: “We faced our biggest operational challenge in many years at SPDC, where a significant decline in crude receipts at the Bonny Oil and Gas Terminal resulted in our declaration of force majeure in March 2022.

‘’I am pleased to say that the force majeure on the Bonny export programme was lifted in March 2023.

“Unfortunately, along with other operators in Nigeria, SPDC continues to face the twin challenges of sabotage and crude oil theft, each of which not only deprives our country and our people of billions of dollars of tax revenue, but also endangers people’s lives.

“Sadly, we were reminded of these dangers in March 2023 when a fire incident occurred at the site of an illegal connection used for crude theft on the Rumuekpe-Nkpoku trunk line in Rivers State. The line was not operational at the time of the fatal incident.

“Crude theft poses a serious environmental risk that impacts not just oil and gas operations but also our communities. Our teams continue to collaborate with the Nigerian government and other stakeholders to eradicate crude theft from our facilities.”

Shortfall very worrisome —Prof Uwaleke

Also reacting to the shortfall in the nation’s oil production, Prof Uche Uwaleke, President, Association of Capital Market Academics of Nigeria, ACMAN, said: “It is a worrisome development. If crude oil production was 1.2mbpd against an OPEC quota of 1.74mbpd, it means that volume deficit is in excess of 500,000 barrels per day.

“This translates to 15 million barrels per month. At a conservative oil price of 85 dollars per barrel (current price is over 90 dollars), it means Nigeria lost over $1.2 billion in one month alone (or nearly N1 trillion @ N765 exchange rate).

“The lost $1.2 billion monthly inflow could have gone a long way to boost external reserves and improve liquidity in the FX market.

‘’The major cause is crude oil theft and the solution is to squarely deal with it using our security forces, working in conjunction with local communities in oil-producing areas.”

Shortfall will put pressure on govt to borrow — Adonri

On his part, David Adonri, who’s the Executive Vice-Chairman at HIGHCAP Securities Limited, said: “The targeted budget of 1.69 mbpd was unrealistic. In the recent past, Nigeria’s crude oil production had hovered around 1 mbpd.

“Pervasive oil theft and declining investment in the upstream sector have stifled production. The reliability of production data is another challenge due to endemic organized corruption in the upstream sector.

‘’The production target is a principal assumption belying the federal budget for 2023. Its under-performance will derail the budget and possibly put pressure on government to borrow or rationalize expenditure.

“The circumstances surrounding the low production level are well known to government.

Appropriate remedial measures should be taken to correct the anomalies. The budget should also be weaned off crude oil dependence. Restoration of firm order in the rural economy will be critical in this regard.”

It’ll further worsen dollar liquidity challenge in FX market — Olayinka

Reacting, Tajudeen Olayinka, CEO, Wyoming Capital and Partners, said: “ The already identified causes are oil theft and production challenges by some oil companies in the Niger Delta.

“It will definitely affect dollar component of the Federal Government budget and further worsen dollar liquidity challenge in the foreign exchange market.

‘’The naira component of the budget may not be seriously affected because of substantial removal of fuel subsidy and naira exchange rate depreciation in the past three months.

‘’Government is already making efforts in the direction of curtailing oil theft but needs to encourage oil companies to improve production capacities. Nigeria needs all the oil she can bring out from underneath the ground at this difficult time.”

FG should readjust budget as caution—Captain Alao

Similarly, Capt Tajudeen Alao, President, Nigerian Association of Master Mariners, said: “Oil export is our major source of income in forex. Others are coming behind and in naira. I wonder why we are not transparent and strict about that sector.

“OPEC will be factual about what comes into the market from Nigeria — 1 .2 million barrels per day. Ordinarily, Nigerian figure should be accepted but one can never be sure of what cannot be accounted for.

“For government to base budget on average of 1.69 million barrels per day, it is based on optimistic projection in production. The economists need to be careful, so we don’t spend what we don’t earn.

“I will advise that we readjust budget on path of caution. We put all arsenals on ground to protect our oil assets. Engage the communities and give them direct benefits to have sense of belonging. Make strict penalties for contraventions by all players in the upstream sector. Invest in human and technology to protect oil assets.”

OPS is concerned — NECA

Expressing concern over the development, Nigeria Employers’ Consultative Association, NECA’s Director-General, Adewale-Smatt Oyerinde, said: “A reduction in oil production, whether because of oil theft or reduction in OPEC quota is a source of concern to Organized Private Sector of Nigeria, OPSN. ‘’With the budget based on 1.69mbd crude production, this reduction has the potential to reduce government’s ability to meet developmental objectives and also increase budget deficit at the end of the year.

“It is hoped that a reduction in government’s revenue due to drop in oil production, will not lead to the temptation to increase taxes or introduce new ones. This will result in further burdening of organized businesses.

“It is instructive to note that we had urged successive governments to diversify the sources of foreign exchange, to deal with fluctuations associated with the global oil market. This remains one of the ways to address the continuous flip in crude oil production and price. “Government should also step up protection of the nation’s crude oil pipelines, while dealing decisively with oil thieves.”

Govt must tackle oil theft — PENGASSAN

Similarly/, General Secretary of the Petroleum and Natural Gas Senior Staff Association of Nigeria, PENGASSAN, Lumumba Okugbawa, said: “First of all, our OPEC quota is about 1.8 million bpd which we cannot even meet as a result of massive oil theft.

‘’You may recall that we raised a lot of dust on this matter with campaigns and advocacy against oil theft. Our production went as low as 900,000 bpd as a result of the theft.

“This increased significantly to about 1.6 million. This must have prompted the budget to be set on 1.69 million. It is regrettable that this ignoble act of theft has resumed again. However, budgets are like forecasts and figures can go up or down against the expectations.

“Of course, performance of the budget will be affected, hence government must do all in its powers to shore up production. One of the ways to do this is to go very hard on oil thieves, especially their sponsors.”

Bad news for Nigeria —Ogbeifun

Also, former PENGASSAN President, Dr. Brown Ogbeifun, said: “It is not cheering news for Nigeria because the administration needs money from crude to diversify into alternative energy sources and develop gas infrastructures as transition fuel.

‘’Besides, Nigeria requires high streams of revenue to meet with its high debt servicing profile. So, low production is not cheering news for Nigeria.

‘’The reasons for our low production include but are not limited to high levels of insecurity of assets and life, and no investor wants to invest in unsecured environments.

“Vandalism, crude theft, divestment of multinationals from onshore to offshore, Russia-Ukraine war, volatility of oil prices, and maturity of some of the fields with declining yields have also compounded Nigeria’s production challenges.”

(Vanguard)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.