FG to reduce number of taxes to 9 to boost business environment – Presidential Panel Chair

The administration of President Bola Tinubu is working to reduce taxes from the current 62 to a maximum of nine, to create a more business-friendly environment in the country.

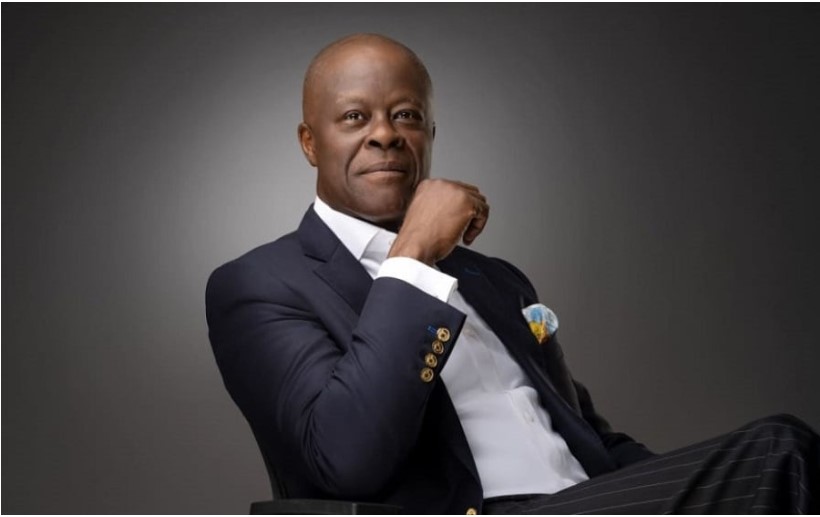

Chairman, Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, disclosed this at the 2023 annual conference of Institute of Chartered Accountants of Nigeria, ICAN, in Abuja, yesterday.

He said the step had become imperative, as the current multiplicity of taxes had made tax administration cumbersome and ineffective.

Oyedele compared Nigeria’s tax revenue of N15.194 trillion in 2022 to the equivalent of N78 trillion revenue of South Africa, with only 10 taxes in the same period.

To achieve the tax reduction goal, he said administrative intervention and constitutional amendment would be required.

In her remarks, the Accountant -General of the Federation, Dr. Oluwatoyin Madein, noted that accountants played very critical roles and unique responsibilities in driving the nation’s development.

According to her, “transparency builds trust”, and such accountants must ensure accountability in both the public and private sectors.

The AGF tasked accountants to also address the unique needs of marginalised communities, with a view to ensuring inclusiveness of the various segments of the nation.

Disparities, threat to nation- ICAN

President of ICAN, Dr. Innocent Okwuosa, warned against growing disparities across socio-economic lines in the country.

“We have chosen not to be silent on the disparities which we consider as a threat to our nation. The wide gap between the rich and the poor is now a threat to the nation. We have been consistent in demanding accountability from the three tiers of government.

“It is evident that addressing socio-economic disparities has become a moral imperative for nations, especially given the widening inequalities across various indicators.

To rectify this situation, key measures should include bolstering fiscal management, rationalising preferential trade restrictions and tax exemptions.

“Such decisive actions would notably enhance the business environment, attract foreign direct investments and reduce inflation,”

Dr. Okwuosa added that there was need for inclusive development blueprint for Nigeria.

In a message, President Bola Tinubu promised to take steps to ensure economic development for all Nigerians.

He said in the message delivered by the Minister of Power, Mr. Adebayo Adelabu, that he was determined to create an “inclusive, equitable and prosperous Nigeria,” adding that “inclusivity is a moral responsibility.”

The president urged accountants to engage in robust discussions on transformative policies that would enhance inclusive development and the administration was committed to learning from ICAN expertise to work towards a batter future for all Nigerians.

Build competences —IFAC President

In her remarks, the President of the International Federation of Accountants, Ms. Asmaa Resmouki, said that accountants must development their competences in order to achieve sustainability and transparency.

She said core competences must apply to business acumen and ethical behaviour.

(Vanguard)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.