Money Laundering: New Act prohibits individuals from cash payments above N5m, corporations N10m – EFCC

Except in a transaction through a financial institution, individuals are prohibited from making or accepting cash payments exceeding N5 million while corporate bodies are restricted from making or accepting cash payments exceeding N10 million.

In the same vein, a person shall not conduct two or more transactions separately, with one or more financial institutions or designate non-financial businesses and professions with the intent to avoid the duty to report such transactions.

These are some of the provisions of the Money Laundering Prevention and Prohibition Act (MLPPA) 2022, showed journalists at a Financial Crimes Reporting Workshop organized by the Economic and Financial Crimes Commission (EFCC), held at the Ibadan zonal command office of the Commission, on Thursday.

The Act, signed into law by former President Muhammadu Buhari, established the Special Control Unit Against Money Laundering (SCUML) domiciled in the EFCC with a mandate to register, certify, monitor and supervise necessary enforcement actions to ensure compliance and conduct off-site, on-site and on-the-spot checks, inspection of designated non-financial businesses and professions for money laundering control and supervision.

Under the Act, as contained in a paper presented by EFCC’s ACE1, Mr Larrys Peters Aso, persons or corporate bodies who exceed the N5million and N10million thresholds are expected to disclose the transaction to the SCUML of the EFCC, in case there is an investigation and the funds are traced to them.

The new Act places on individuals and corporate organizations the responsibilities to identify their customers and persons purporting to act on behalf of their customers, preserve records on both domestic and international transactions for at least five years after the completion of the transaction, keep account files and business correspondence for at least five years following termination of the business relationship.

Under the act, financial institutions, non-financial businesses and professionals are mandated to verify the identity of their customers and take reasonable measures to verify that any person purporting to act on behalf of the customer is so authorized.

Designated non-financial businesses and professions are listed to include legal practitioners and notaries.

Also explained that the Act restricts the lawyer-client confidentiality privilege, as it stipulates that such privilege shall not apply in connection with the purchase or sale of property, business; management of client money, securities or assets, management of trusts, companies, banks, savings or securities accounts.

Aso explained that the intent of the new Act is for individuals and corporate organizations to share in the responsibilities of preventing and fighting money laundering, and will not shield individuals and corporate bodies from being victims of money laundering or being aiders and abettors of money laundering.

Also expected of individuals or corporate organizations are a duty to report suspicious transactions within 24 hours of such transactions, report international transfer, transportation of funds, securities and cash exceeding $10,000 or its equivalent to the Nigerian Financial Intelligence Unit (NFIU), Central Bank of Nigeria (CBN) or the Nigerian Customs Service (NCS).

Section 18 (2), sub-section 1 of MLPPA 2022 provides that a person may be deemed guilty of money laundering if he or she conceals or disguises the origin of money, converts or transfers money, removes from the jurisdiction, acquires, uses, retains or takes possession or control of any fund or property, intentionally, knowingly or reasonably ought to have known that such fund or property is, or forms part of the proceeds of an unlawful act.

Also, the Act prohibits numbered or anonymous accounts, while giving competent authorities power to obtain and inspect books and records of a financial institution or designated non-financial institution business and profession to confirm compliance.

The Act empowers competent authorities to stop transactions, block funds, place bank accounts under surveillance, conduct due diligence on politically exposed persons to establish their source of wealth, source of income, and obtain and inspect books and records of virtual assets.

The Act also mandates the Attorney-General of the Federation to, every two years, cause to be prepared for submission to the president, a Nigerian Money Laundering Strategy Report which shall contain contributions from all competent authorities.

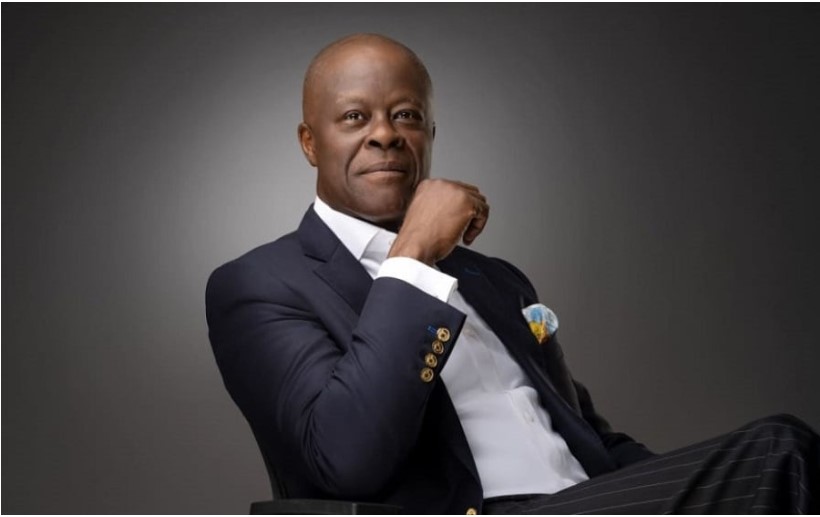

In his opening remarks, acting Executive Chairman, Abdulkarim Chukkol, represented by the Acting Zonal Commander, Ibadan, Halima Mustafa Rufa’u, said it was gratifying that the commission had recovered several billions of naira following its strengthening of the anti-money laundering framework.

Under the Money Laundering Act, 2022, he said, family members and close allies of politicians and public office holders, including top civil servants are now classified as politically exposed persons.

He stated that family members, friends of politicians and others holding political offices run the risk of going to jail if they allow their companies or bank accounts to be used to launder proceeds of illegal activities.

He also cautioned youths against internet-related fraud activities, rather, he said, they should productively use cyberspace for legitimate pursuits.

Noting that the EFCC was up to speed with new trends in Cybercrime, EFCC’s CSE, Taibat Sallahdeen, in her paper presentation, enjoined Nigerians not to fall victim to cyber criminals by adhering to appropriate preventive measures.

He listed some of the preventive measures to include people being circumspect in making online purchases, regularly backing up their data, having up-to-date software, using only reputable security software, ensuring two-factor authentication, having long passwords, being cautious in opening emails and attachments, their exposure on social media, using WiFi networks.

A spokesperson for the EFCC, Mr Wilson Uwujaren and ACE1, Mr Dele Oyewale, in their presentations, tasked journalists on investigative journalism to assist the commission in the fight against money laundering.

(Tribune)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.