Naira gains as CBN pays banks $6.7bn forex backlog

The Federal Government through the Central Bank of Nigeria, has commenced payment of outstanding matured FX forwards owed to various creditors, the PUNCH can report.

A source familiar with the development confirmed the payment on Thursday.

Meanwhile, unconfirmed sources said three banks received full payment of debts owed.

The banks are Citi Bank, Stanbic IBTC and Standard Chartered Bank.

The amount of overdue forward payments is estimated at $6.7 billion, according to the Minister of Finance, Wale Edun.

Meanwhile, the naira has risen to N1,120 against the dollar as the foreign exchange market reacted to news that the Central Bank of Nigeria has begun to clear some of its FX backlog on Thursday.

This represents an appreciation of N50 or 4.27 per cent compared to the N1,170 it traded for on Wednesday. Currency traders, also known as Bureaux De Change operators, who spoke to The PUNCH stated the naira was recovering well after making a quick recovery from N1,170/dollar in the morning to close trading at N1,120/dollar.

The naira in Lagos recorded an average of 1,120/$ on Thursday, appreciating to 1,040/$ and 1,125/$ in different locations on Thursday. It traded at 1,170/$ on Wednesday. In Abuja, the average price of the naira against the dollar was 1,200.

However, The PUNCH reports that 21 commercial institutions are operating in the country.

The source said, “Three banks payment received full payment from the CBN. On the amount, no bank would want to disclose that information.

Statements from two of the banks, obtained by The PUNCH, confirmed the payment of FX forwards by the CBN.

Stanbic IBTC in a statement said, “Yesterday, the apex bank began clearing the backlog of outstanding Retail SMIS obligations. The total amount cleared is yet to be ascertained.”

Also, Citi in a statement issued by its Treasury and Trade Solutions department, exclaimed, “CBN HAS DONE IT.”

The bank enjoined its customers to begin to speak with their respective Relationship Manager or Trade Service Professional for clarification on the matter.

The circular titled ‘Settlement of Matured FX Forwards by CBN’, said, “We have been directed to inform you that the CBN has delivered all outstanding matured forward forex.

“We thank you for your patience and cooperation and value you for your business and partnership. Please speak with your Relationship Manager or your Trade Service Professional for clarification and additional details.

“It is a gradual payment that was done secretly, CBN didn’t make a fuss about it. It started yesterday and continued all through the night.”

The source added that paid banks represent a small percentage of outstanding FX forwards with the largest percentage mostly in tier 1 banks yet to be settled.

He, however, expressed hope that they will be settled in the next tranche maybe with a lower percentage.

The CEO of a Tier 2 bank who does not want his name mentioned, also confirmed that his bank received $100m from the CBN, expressing confidence that the outstanding would soon be settled.

He said, “As I speak with you, our bank has been credited with $100m by the Central Bank and we are confident of getting the balance soonest. This is a positive development for the economy and trade in particular.”

However, there are commercial banks in the system that are not happy with the CBN because they have yet to receive any credit alert.

Sources at the CBN who spoke to The PUNCH unofficially said, “The banks who have not received payments are grumbling, alleging that the Apex bank has denied them of their rights.”

Reacting, the Association of Corporate Treasurers of Nigeria said the decision to settle matured foreign exchange forwards is a significant step in promoting stability and confidence in Nigeria’s foreign exchange market.

The association comprising all corporate treasurers in Nigeria in a statement obtained by our correspondent said the action demonstrates the apex bank’s commitment to ensuring the ease of doing business and reducing uncertainty in the market.

The statement signed by the association president, Adeyinka Ogunnubi, read, “We, at ACTN, believe that the timely settlement of matured FX forwards is crucial for our members and the broader business community. It allows our corporate treasurers to efficiently manage their foreign exchange risks and plan for their financial obligations.

“We recognize the CBN’s responsiveness to the concerns of businesses and its continued efforts to implement policies that enhance the resilience of the Nigerian financial system.

“As an association dedicated to advancing best practices in corporate treasury management, ACTN will continue to work closely with regulatory authorities to support policies that foster transparency, predictability, and stability in Nigeria’s financial markets.”

Also reacting, the Director General of the Nigeria Employers Consultative Association, Mr Wale Oyerinde, said, the actions of the new administration of the Central Bank of Nigeria have shown tremendous improvement in the FX management.

He said, “Well, there is no doubt that the economy lacked the requisite FOREX to completely close down the outstanding matured FX in banks. However, the actions of the new administration through the CBN have shown tremendous improvement in FX management, which was a huge challenge in the last administration. The current CBN management has stepped up forex intervention in the FOREX market, which is now accounting for 75 per cent delivery of the matured FX. While we commend this action and the determination to clear all the standings, we hope that this effort will be sustained. The sustainability of this intervention will largely depend on the guarantee of FOREX inflow from all available sources. With stable, focused and growth-induced reforms, another opportunity for FOREX like increased FDI will be enhanced,” Oyerinde added.

Also speaking, the immediate Vice President of the Manufacturers Association of Nigeria, Lagos Zone, Mr John Aluya, said he is yet to be informed of any of their members whose backlogs have been cleared.

Aluya, who is also a current member of the National Council of MAN, noted that if the initiative is properly implemented, it will help to improve the system. But he said that commercial banks may likely frustrate the move by the apex bank.

“But if this move is well implemented, it could be an initiative that could be done in such a way that it will be an improvement in the system. But I will tell you that for every step the CBN takes the big elephants in the house are always there to truncate it and if the CBN is not careful the big elephants will also truncate this move that they are about to make. The big elephants I mean are the commercial banks. They are the people who have always made our exchange rate unreliable because they benefit from it. When you talk of the I&E window you bid for it but manufacturers do not enjoy the window, because the banks will tell you that you will bid for I&E at CBN rate, and they will give you another account to pay the difference into and that is truncating the system.”

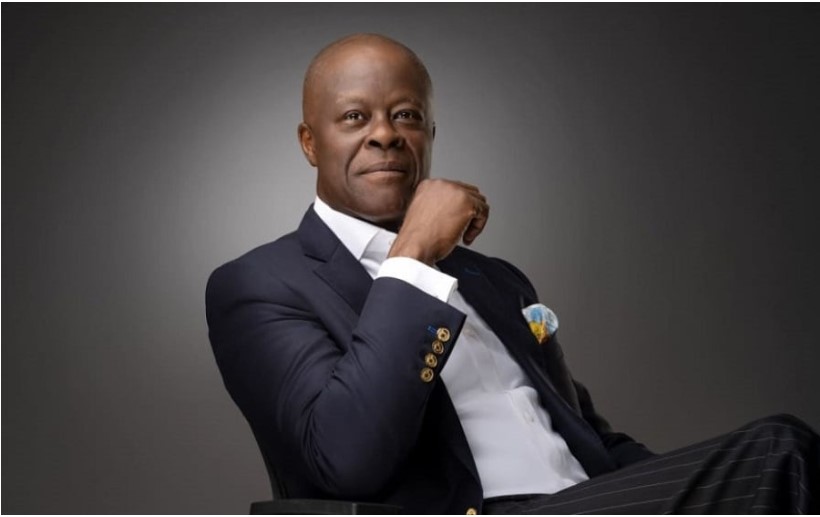

The Chairman of the Nigerian Economic Summit Group, Mr. Niyi Yusuf, said, “This is in the news and it’s useful that the administration is delivering on its public commitments which should help to improve public confidence. It’s a good signal and a right step to rebuilding trust and confidence,” he concluded.

The Chairman of the Nigerian Association of Small and Medium Enterprises, South-West region Chairman, Solomon Aderoju, queried if the payments would get to the end users.

He said, “Will it get to the end users? How much have they cleared? If it will get to the importers and the end users, then, it’s a good development. If not, then, it’s still the same story. Nigeria’s problem is multidimensional. Even with the 43 items that they removed, are the importers now getting the forex from the banks? I am sure they are still using the black market.

“Over the years, we have been using the foreign reserve. The reserve has been depleting over the years because we are not adding anything to export. It’s the only export that can add to the reserve. So, it’s a deficit account.”

The former Chief Economist of Zenith Bank, Marcel Okeke, said, “The exact amount is not known. Where did they get the money? What are the terms of the borrowing? How much have they cleared? The secrecy around the management of foreign exchange by the CBN is now a concern. You no longer know the rate at the official window exchange. If they say they are now clearing, how? The international communities are watching, they are worried, and nobody is impressed. The government has not done anything to improve government supply. Even investors are not coming. Aside from these issues, there are other myriads of problems. The business climate is not encouraging. Are investors coming because we have the best infrastructure, are they coming because we have security? What exactly? “

The PUNCH had reported that President Bola Tinubu assured Nigerians and investors that there was an ongoing plan to boost the country’s foreign exchange liquidity.

This was as the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said that the country was expecting about $10bn inflows in the nearest term, which would help to clear foreign exchange backlog and stabilise the naira.

Speaking at the 29th Nigerian Economic Summit in Abuja recently, Tinubu acknowledged the challenges faced by the business community in the financial markets and assured them of additional foreign exchange liquidity to restore market confidence.

On clearing the FX backlog which has drained investor confidence, the president said, “All foreign exchange future contracts will be honoured by this government.”

“I assure you we have a line of sight to the foreign exchange we need to refloat this economy. And we will get it,” he added.

Naira Gains

The president of the Association of Bureaux De Change Operators of Nigeria, Aminu Gwadabe, affirmed to The PUNCH that the dollar closed trading at N1,120/dollar on Thursday. He attributed this to the CBN’s move to clear some of its backlog.

He said, “It is closing at N1, 120. Even yesterday it came down to N1,150. Today, it started at N1,170 but it is closing at N1,120. Yes, this is because of the CBN’s move to clear its backlogs. There is a kind signal in the market. The CBN should continue to make clarifications.”

In Abuja, the naira exchanged at 1,170/$ on Thursday at the parallel market, as liquidity challenge persisted, according to some Bureau de Change Operators.

Some BDC operators who spoke to The PUNCH said this was a slight improvement from the 1,200/$ traded on Wednesday.

An Abuja-based Bureau de Change said the naira was gradually improving but had yet to regain its true value.

He said, “The naira is improving but very high compared to what we were trading before the current administration.”

Another BDC operator who spoke to our correspondent said the naira traded for N1,115/$.

He further lamented that there was a significant crash in the parallel market, forcing traders to stop sales of dollars.

He said, “We experienced significant loss today as the dollar suddenly crashed. Most of us have stopped for now to see what the market holds. If it reduces tomorrow, we may have to sell at a loss.”

A BDC operator at Wuse Zone 4, Abuja, lamented the huge crash of the dollar against the naira, noting that the gains recorded by the Nigerian currency had confused the traders operating in the parallel market.

According to him, the naira gain had put many forex dealers in crisis and debt.

‘’I bought $20,000 yesterday (Wednesday) and now that the dollar has crashed, it has put me in a big trouble. I’m confused right now because I have suffered a huge loss. I need to get someone to buy the dollars before it crashes further,’’ he said on the phone on Thursday.

Meanwhile, the naira appreciated by 0.76 per cent at the official market to close at N793.28 to the dollar on Thursday from N799.32/$ on Wednesday according to details on FMDQ OTC Securities Exchange.

Data from the platform which oversees official foreign exchange trading in Nigeria revealed that the highest price recorded within the day’s trading was N1,018.60/$, and the lowest price was N730.00/$.

On Thursday, news broke that the apex bank had begun to clear some of its foreign exchange backlogs. Sources close to the matter confirmed that the apex bank had settled some of its FX obligations with certain banks such as Citibank, Stanbic IBTC, and Standard Chartered, among others.

Recently, the Federal Government announced it was expecting $10bn to clear forex backlogs and stabilise the naira. The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, disclosed this at the 29th Nigerian Economic Summit.

He said, “In addition, from the supply of foreign exchange through NNPC, increased production, reduced expenditure, from transactions such as forward sales, from our discussions with sovereign wealth funds, which are ready to invest and provide advanced alongside that investment, there is a line of sight of $10bn worth of foreign exchange in the relatively near future in weeks rather months.”

JP Morgan’s Report

JP Morgan’s Reaction in a report published on Tuesday said it expects authorities to maintain some willingness for a somewhat flexible exchange rate (at least relative to recent years)

However, the large backlog of unmet FX demand and relatively low net international reserves make it a challenging task. Authorities hope to secure around US$10bn of new inflows to help ease the FX backlog challenge, but they should also consider other FX reform measures

JP Morgan disclosed that Nigeria now ranks highest on its risk-reward scorecard due to elevated carry. It however said, “We remain on the sidelines waiting for better line of sight on FX inflows and more consistent liquidity tightening measures Central Bank of Nigeria held its second OMO auction of the year, pushing short-term rates higher, thus further normalizing policy.

Expected sources of funding

According to JP Morgan, ”The government is hoping to secure up to US$10bn in FX inflows over coming months in a bid to clear a substantial portion of the FX backlog and improve market liquidity. Media reports suggest this is split between US$7bn from the securitization of future gas dividends to the government, and US$3bn from the securitization of future oil-related dividends.

“The ability of the government to raise such amounts via these channels may be challenging given the US$3bn expected from Afrexim has been delayed for months, while Nigeria LNG Limited’s historical dividends to the government have fallen well short of US$2bn annually. It also doesn’t help that the NNLG Managing Director recently confirmed that the company is operating at 50% capacity on its Train 1-6 fields and plans to expand its processing capacity with Train 8 is no longer feasible. That said, the government appears to be in the final stages of agreeing a US$3.5bn package with the World Bank (part of which would be direct budget support, while the rest will be project-linked) with other reports suggesting funding from sovereign wealth funds in the middle east may be on the cards.”

(Punch)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.