Nigeria has final say on petrol subsidy removal – IMF

The International Monetary Fund (IMF) has said Nigeria’s plan on whether to remove petrol subsidy or not remains a political and domestic decision for the country’s leadership.

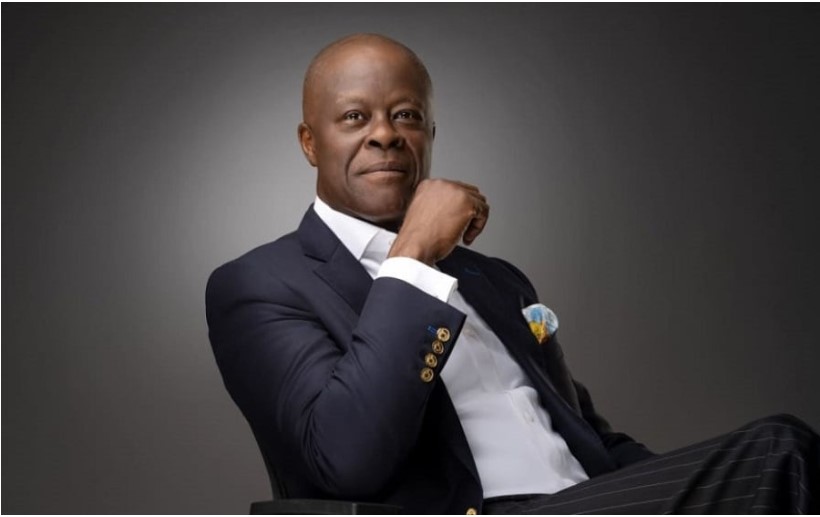

Speaking at the Sub-Saharan Africa Regional Economic Outlook press conference during the IMF/World Bank Spring Meetings in Washington, the Director, IMF’s African Department, Abebe Selassie, said Nigeria spends so much on petrol subsidy, when much investment is needed to shore up health and educational sectors.

Selassie said knowing when to subsidise and to what extent, is a very deeply domestic and political question. “If government wants to do that, that’s fine, but we think it’s suboptimal, as I said, for reasons I explained earlier that the benefits of subsidies tend to accrue to to richer households. But if that’s what the government is deciding, that’s fine. Removing them also, I think, is of course part of the split, you know, political and domestic debate that needs to be heard,” he said.

“Continuing, Selassie said: “We know of course in Nigeria, fuel subsidies eat up tremendous amount of resources at the same time that the government doesn’t have resources to address huge investment needs.”

Selassie said there is so much investment need from health, education to infrastructure, but this is a choice for the Fedral Government and civil society to make on where to put the funds.

“We have also heard, you know, the discussion that’s going on, on whether this is ideal. We try and inform that debate with numbers and practices elsewhere, and I think that is our role, and I look forward to whatever decision the government takes on that,” he stated.

Selassie said growth in sub-Saharan Africa (SSA) is expected to slow to 3.6 per cent as a “big funding squeeze”, tied to the drying up of aid and access to private finance, hits the region. This is the second consecutive year of an aggregate decline in SSA growth.

He added that if no measures are taken, this shortage of funding may force countries to reduce fiscal resources for critical development like health, education, and infrastructure, holding the region back from developing its true potential.

“The IMF is playing its part. Between 2020 and 2022, the IMF provided more than $50 billion to the region, more than twice the amount disbursed in any 10-year period since the 1990s. And as of March 2023, the IMF had lending arrangements with 21 countries, with more requests under consideration”.

He called for consolidation of public finances and strengthening financial management, containing inflation, allowing exchange rates to adjust, while mitigating the adverse effects on the economy, and ensuring important efforts to tackle climate change do not crowd out financing for basic needs like health and education.

“Growth across the region varies from country to country. Some countries, particularly those in the East African Community, or non-oil resource intensive countries, are expected to fare better, but some major economies bring down the average SSA growth rate, like South Africa where growth is projected to decelerate sharply to only 0.1 per cent in 2023,” Selassie said.

He said rapid tightening of global monetary policy has raised borrowing costs for African countries on domestic and international markets.

Advertisement

“All sub-Saharan African frontier markets have been cut off from market access since spring 2022. The dollar effective exchange rate reached a 20-year high last year, increasing the burden of dollar-denominated debt service payments. Interest payments as a share of revenue have doubled for the average SSA country over the past decade,” he said.

Nation