Projected $1tn economy: DMBs to increase capital base, says CBN Gov

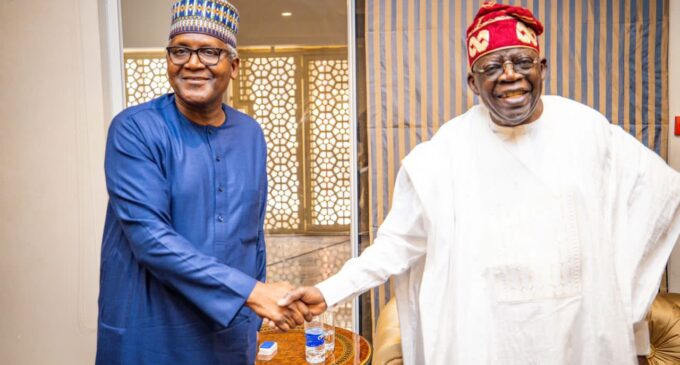

The Governor of the Central Bank of Nigeria, Dr Olayemi Cardoso, has said that the apex bank will be asking Deposit Money Banks to increase their capital base in order to service the $1tn economy projected by President Bola Tinubu.

This is as he noted that he knew that there was much work to be done in the way the apex bank ran its operations, adding that he would need the collaboration of all stakeholders.

Speaking on Friday at the 58th Annual Dinner of the Chartered Institute of Bankers of Nigeria in Lagos where he was the special guest of honour, Cardoso said, “In my recent speech at the 370th Bankers’ Committee meeting, I highlighted the economic agenda of the President. The administration has set an ambitious goal of achieving a GDP of $1tn over the next seven years.

“Attaining this target necessitates sustainable and inclusive economic growth at a significantly higher pace than current levels. It is crucial to evaluate the adequacy of our banking industry to serve the envisioned larger economy.

“It is not just about its current stability. We need to ask ourselves, can Nigerian banks have sufficient capital relative to the finance system needs in servicing a $1tn economy in the near future, in my opinion, the answer is no, unless we take action. As a first test, the central bank will be directing banks to increase their capital.

“Therefore, we must make difficult decisions regarding capital adequacy. As the first step, the CBN will be directing banks to increase their capital.”

He added that it was crucial to prioritise price stability to safeguard the livelihood of Nigerians.

He also blamed the recent negative perception of the apex bank on corporate governance failure, diminished independence and deviation from the core mandate, inefficient forex rules, and venture into development financing.

“I’m confident and optimistic that by taking appropriate corrective actions and strategic steps, we can restore macroeconomic stability and address fundamental flaws,” he stated.

Cardoso also noted that the fluctuating exchange rate was hampering business growth and promised to be transparent and fair to all as the bank performs its function.

He added, “The removal of petrol subsidy and the adoption of a floating exchange rate and other government policies are anticipated to have a positive effect on the economy in the medium term.

“These measures are expected to enhance investors’ confidence, attract capital inflow, stimulate domestic investors and ultimately improve the level of external reserves. Additionally, they are expected to contribute to the stability of the local economy.

“Despite the challenging global and local economic environment, Nigeria’s financial sector has demonstrated resilience in 2023 with key indications of financial soundness largely meeting regulatory benchmarks.

“Stress test conducted on the banking industry also indicates its strength under mild to moderate scenario on sustained economic and financial stress. Although there is room for further strengthening and enhancing resilience to shocks. Therefore, there is still much to be done in fortifying the industry for future challenges.”

Cardoso also noted that the previous forex ban on those 43 items widened the gap between official and parallel market rates.

Speaking on the activities of the CBN before his appointment, Cardoso stated that the quasi-fiscal policies of his predecessor, Mr Godwin Emefiele, resulted in N10tn being pumped into the economy through intervention programmes.

He said, “I am aware that events over the past few years have also put the CBN in a bad light. These issues can be attributed to various factors, such as corporate governance failures, diminished institutional autonomy of the Central Bank of Nigeria, a deviation from the core mandate of the Bank, unorthodox use of monetary tools, an inefficient and opaque foreign exchange market that hindered clear access, a foray into fiscal activities under the cover of development finance activities. There was also a lack of clarity in the relationship between fiscal and monetary policies, among other challenges.

“Hitherto, the CBN had strayed from its core mandates and was engaged in quasi-fiscal activities that pumped over N10tn into the economy through almost different initiatives in sectors ranging from agriculture, aviation, power, youth and many others. These clearly distracted the bank from achieving its own objectives and took it into areas where it clearly had limited expertise.”

The apex bank boss however promised that the issues affecting the bank would be tackled under his watch.

He said, “Under my leadership, the Central Bank of Nigeria will vigorously address these issues. We will tackle institutional deficiencies, restore corporate governance, strengthen regulations, and implement prudent policies. We assure investors and the business community that the economy will experience significant stability in the short-to-medium term as we recalibrate our policy toolkits and implement far-reaching measures.”

The President/Chairman-of-Council at the CIBN, Ken Opara, in his welcome address, pointed out that governors of the CBN as the guest speaker had historically used the platform to share perspectives on economic and financial market development in the current year and provide insights into its economic outlook for the year ahead.

Opara went on to highlight some of the initiatives from the CBN since Cardoso took office and stated that there was still much to do.

“It is important to mention that within the short time in office, the Central Bank governor has activated some key initiatives aimed at repositioning and stabilising the economy.

“I will mention a few, focusing on the core monetary mandate of price and exchange rate stability, the unification of the exchange rate, and initiating steps to improve liquidity in the foreign exchange market, therefore achieving real positive change.

“We are on a journey and we are not yet there but we believe that we are progressing as we are not oblivious of the inflationary pressure that has intensified and has reached a high of an all-time high of 27.33 per cent in October 2023 while the exchange rate continues to rise. We believe that the focus should continue to be on reforms and incentives that will boost non-oil export revenue as well as attract Diaspora and foreign portfolio investment.

“These achievements tie into the Renewed Hope Agenda of the President, whose comprehensive development plan aims to address Nigeria’s most pressing challenges as encapsulated in the eight points agenda of economic growth and transformation, access to capital, job creation, food security, ending poverty, improved security, rule of law, fighting corruption and improved playing field for business to operate.”

The Vice President, Senator Kashim Shettima, was represented by the Special Adviser to the President on National Economic Council and Climate Change, Mrs Rukayat El-Rufai.

Lagos governor, Mr Babajide Sanwo-Olu, represented by the Commissioner of Finance, Abayomi Oluyomi, in his goodwill message said, “In the last few months, we have witnessed what have been described as the new dawn in the management of our monetary policy and fiscal policy in line with the renewed hope agenda of the current administration led by President Bola Tinubu.

“I am confident that in the first full fiscal year of this administration and the management of the Central Bank of Nigeria under Dr Yemi Cardoso, these anticipated positive impacts of the monetary and fiscal policies of the new administration will fully manifest in our macro and micro economic indices, most importantly, for us as politicians, in the living conditions of our people.”

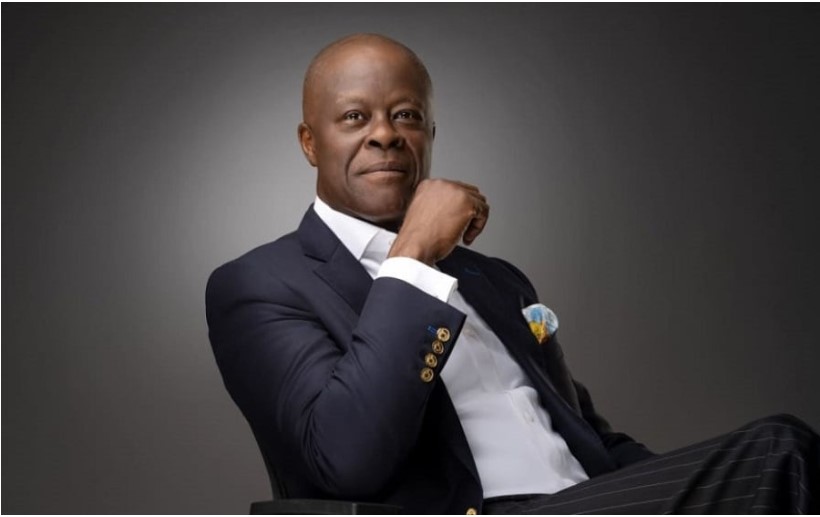

In his remarks, the Chairman of the Body of Bank Chief Executive Officers, Ebenezer Onyeagwu, stated that the banking industry was becoming stronger even as the issue of FX forwards is being dealt with.

Onyeagwu, who is also the Group Managing Director/CEO of Zenith Bank Plc, said, “The industry is getting stronger and the elephant in the room, FX forwards has been caged and we are moving forward.”

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, in his goodwill message, said, “The industry is thriving and relatively healthy. Taking Nigerian banks to the rest of Europe and other regions shows what we are able to offer the rest of the financial world. It has been difficult but we must stay the course.”

(Punch)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.