Seek $13B debt forgiveness from creditors to stabilise economy, Afenifere advises Tinubu

*Advises president to cut cost of governance, halt hike in FG’s tertiary institutions’ tuition fees

*Fitch: Nigeria’s inflation to average 25.1% in 2023 as poverty rate spikes

*Says real GDP growth to slow to 2.7% on high living cost

*Growth expected to accelerate modestly to 3.2% in 2024

*Forecasts Dangote refinery to begin operation, bring relief by Q4, 2023

The pan-Yoruba socio-political organisation, Afenifere, has called on President Bola Tinubu to take five-pronged approaches to prevent the country from total socio-economic dislocation, one of which is for the president to seek debt relief from the country’s major creditors.

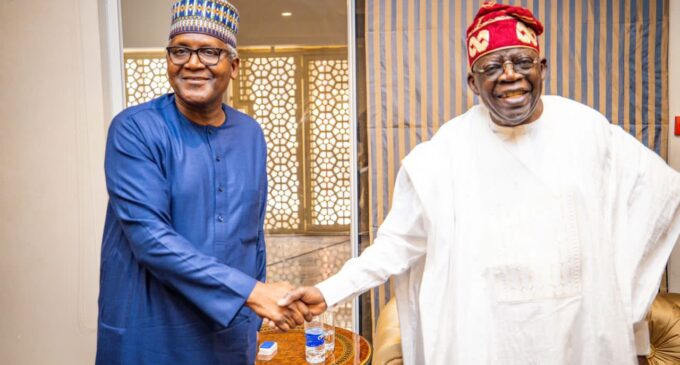

The recommendation by Afenifere came just as the National Chairman of the South West Agenda for Asiwaju (SWAGA), Senator Adedayo Adeyeye, appealed to Nigerians to remain calm in the face of current pains and hardship caused by the removal of fuel subsidy by the Tinubu-led administration.

Also, Fitch Solutions, a global provider of credit, debt market as well as country and industry risk research, at the weekend predicted that the current economic reforms embarked upon by the Tinubu government would dim Nigeria’s short-term outlook, predicting that average inflation rate would hit 25.1 per cent this year, amid spiking poverty.

The recommendation by Afenifere was contained in statement signed yesterday by its National Publicity Secretary, Jare Ajayi.

The recommendations also included drastic reduction in emoluments, slash in the size of government, ways to go about palliatives and to halt the recent hike in tuition fees.

Ajayi said the current economic quagmire facing Nigeria needed far-reaching and deep-rooted steps to be ameliorated.

Consequently, he suggested that: “One of such steps is to seek debt relief from our major creditors. Another is to drastically reduce the size of government at all levels. Third is to block areas of leakages of public resources, especially finance. Fourth is to embark on policies or programmes that are capable of engaging millions of unemployed people, old and young, in the country.

“The fifth step is to ensure that security and safety of lives and properties become permanent feature in the Nigeria firmament.”

Ajayi pointed out that, “Nigeria is the fourth most indebted country in the world, with a $13 billion debt burden as of June 30, 2022 according to the United Nations’ International Development Association (IDA).”

According to Ajayi, the five steps suggested would have to be pursued simultaneously for the inherent benefits to be harnessed effectively and on time.

He added: “At the moment, Nigeria’s debt profile is so huge that it is spending about 97 per cent of its revenue to service debts, according to many official sources including the Debt Management Office (DMO), Federal Budget Office, Ministry of Finance and the World Bank.

“The situation is such that very soon there may be no more fund for the provision of social services and infrastructure. To prevent attendant possible social chaos in this respect, President Tinubu needs to embark on diplomatic shuttles to get debt forgiveness from our creditors.

“Doing so would certainly be herculean in view of a similar benefit we enjoyed under former President Olusegun Obasanjo circa 2005 but which we later mismanaged.

“But given the potential of Nigeria and the possibility of President Tinubu to convince everyone that his own administration is going to be different, it is possible that the creditors may listen to the plea.”

The Afenifere spokesperson opined however that for such a plea to succeed, there was an, “urgent need to drastically cut down on the emolument of public officials, especially political office holders, block the holes through which public funds leak and wage a serious war against corrupt officers – presently in or out of office.”

It noted that it was only by doing these three things that “those we approach for debt forgiveness would listen to us.”

He pointed for instance, that, “the National Assembly cornering N70 billion out of the N500 billion announced for palliatives is not only uncalled for, it demonstrated clearly how insensitive our elected officers are to the plight of average Nigerians.

“The president should prevail on them to rescind their decision in this regard.”

He said the country’s debt burdens explains why infrastructural development stagnated, social services virtually grounded to a halt and cost of living spiked, unemployment soared – leading to an increase in crime rates and increasing loss of faith in the country as reflected in the Japa syndrome (the tendency by many to want to emigrate).

Ajayi called on the Tinubu’s administration to make the resuscitation of moribund industries in the country one of its major priorities, stating that doing so would create employment, reduce crimes, boost the nation’s economy, strengthen the naira and earn the country foreign exchange.

“Government should refrain from increasing taxes and fees for now but explore ways of enhancing productivity and reduce pains,” the group advised.

He commended President Tinubu for the decision to review the N8,000 palliative meant to cushion the effect of subsidy removal.

According to Ajayi, “Palliatives, to be really helpful and effective should be welfare-enhancing in nature and not be in form of unregulated cash dole-out. Such a money should rather be channeled towards the things that cash is used for.”

He said for instance, passenger and luggage vehicles could be procured and allocated to all the local government areas in the country and boats earmarked for riverine areas.

He suggested that the, “vehicles should be put at the disposal of local government authorities and transport unions across the country so as to be of benefits to the target audience – the masses. Fares for the vehicles should be about one-fifth or a quarter of the prevailing rates.

“The vehicles should be given to the transport unions at a highly concessionary rate. Similarly, government can buy food items directly from farmers and make them available at very cheap prices in designated areas”.

As a lasting solution to the high cost of petroleum products, he advised that conducive atmosphere should be provided for private importers to import them with relative ease while efforts are geared towards making the refineries in the country commence production for the commodities not only to be available, but to be cheaper. Their availability, he said, “would also boost the economy and earn the country foreign exchange.”

The Afenifere spokesman stressed the need for the president to prevail on electricity distribution companies to stop their attempts to increase tariffs for now.

“For one, there has been not much improvement in electricity supply to justify tariff increase. But more importantly, Nigerian masses are presently over-burdened with sundry taxes and high costs for services and commodities.

“The Discos must not be allowed to deepen the miseries of hapless Nigerians. Similarly, recent hikes in school fees across the country should be rescinded so as to prevent more hardship for the people and higher number of school drop-outs,” he added.

Meanwhile, Adeyeye has appealed to Nigerians to remain calm in the current pains and hardship caused by the removal of petrol subsidy.

Adeyeye, who was Senate spokesperson in the 9th National Assembly, made the appeal in a statement he personally signed and made available to journalists in Abuja, yesterday.

He explained that the hardship was much now because the decision taken by Tinubu should have been carried out by successive administration, in the last 15 years.

He, nevertheless, assured that situations would soon improve and that Nigerians would laugh last.

Part of the statement read, “The removal of oil subsidy and the new exchange rate regime of the President Bola Tinubu for now, has led to inflationary pressure. This is causing some hardship on the part of the masses.

“As the saying goes, there is no gain without pains. Like the president has said that while trying to give birth, one must go through the pains of labour, however when the child is born, the safe birth will keep the mother happy.

“Her pain of a few hours would therefore lead to everlasting joy.

“Nigerians should see the economic reforms of president Bola Tinubu from that perspective. If President Bola Tinubu has not taken those steps, it could have led to a complete crash of the Nigerian economy with its attendant social, economic and political implications.

“The pains we are currently going through, will soon go and by this time next year by the grace of God, Nigerians would begin to see the results of the steps that the president has taken.

“The president is just about 60 days in office. He still has over 46 more months to spend in his first term of 48 months, having spent just two.

“President Bola Tinubu is taking decisions that should have been taken over 15 years ago.

“Nigerians should give President Tinubu some time, to allow his policies to mature and for us to begin to see the positive effects.

“The president has said he understands the pains of Nigeria, we should just exercise patience, ultimately Nigerians would give glory to God, along the line,” Adeyeye added.

Fitch: Nigeria’s Inflation to Average 25.1% in 2023 as Poverty Rate Spikes

Meamwhile, Fitch has predicted that inflation rate in the country would hit 25.1 per cent this year, amid spiking poverty.

Since he took over the reins of power in the country, Tinubu has ended Nigeria’s prolonged petrol subsidy regime and has halted the country’s divergent foreign exchange rate.

As expected, both decisions have led to a spike in the pump price of petrol while the exchange rate has recently exceeded N800/$, causing uproar among the citizenry.

In the report themed: “Key Economic Reforms Dim Nigeria’s Short-Term Economic Growth Outlook”, Fitch projected that the country’s real Gross Domestic Product (GDP) growth would slow to 2.7 per cent in 2023, down from 3.3 per cent in 2022, as rapidly increasing living costs weigh on domestic demand.

However, Fitch noted that economic growth would accelerate modestly to 3.2 per cent in 2024, while domestic demand will remain poor due to high inflation, favourable trade dynamics following the start-up of the Dangote refinery which is expected to support growth.

“We project that real GDP growth in Nigeria will slow to 2.7 per cent in 2023, down from 3.3 per cent in 2022, as rapidly increasing living costs weigh on domestic demand,” it stated.

It added that the assumed uptick in economic activity in Q2, 2023 will not be maintained in H2, 2023 on soaring consumer prices as economic reforms weaken domestic consumption.

“Indeed, the naira has lost 40 per cent of its value against the US dollar since the liberalisation of the exchange rate on June 16.

“These reforms will exert significant upward pressure on consumer prices in H2, 2023, with inflation set to average 25.1 per cent in 2023, the highest annual rate since the 1990s. This will further erode consumers’ purchasing power, clouding the outlook for private consumption,” Fitch stated.

According to Fitch, efforts to alleviate the impact of rising inflation on households would yield limited results.

On Tinubu’s plan to borrow $800 million from the World Bank to scale up the country’s National Social Safety Net Programme, which would likely impact 12 million low-income households that would receive a monthly payment of N8,000 ($10.30) for six months, Fitch noted that it would have little or no impact.

“However, considering our estimate that the average monthly disposable income per household in Nigeria stands at N143,500, an N8,000 hand-out will only increase household incomes by roughly 6 per cent, well below the inflation rate, which will surpass 25 per cent y-o-y in the coming months.

“Given our expectation that real wages will drop and poverty rates will increase, we expect that private consumption will decline by four per cent in 2023, from a contraction of 3.5 per cent in 2022, shaving off 2.7 percentage points (pp) from headline GDP growth,” the report added.

Fitch said the outlook for fixed investment also remains downbeat, with weak economic conditions resulting in a slowdown in loan uptake in Q4, 2022, implying that domestic investment will weaken.

On a cheering note, it stated that net exports will offer some relief to the Nigerian economy in 2023, projecting that crude production in Nigeria will increase by 7.0 per cent this year – following a three-year contraction – as security agreements and wider efforts to reduce theft pay off and increases Nigeria’s export potential.

“Indeed, crude output rose by 3.3 per cent y-o-y in H1, 2023 to an average of 1.3 million barrels per day. While we believe that liquids production will moderate somewhat compared to the H1, 2023 output, the year-on-year growth figure will remain positive due to favourable base effects.

“Given that hydrocarbons account for roughly 90 per cent of Nigeria’s total exports, this will improve the country’s external trade outlook in H2, 2023,” it stated.

Meanwhile, Fitch stated that it expects a substantial contraction in imports as a result of weak domestic consumption, noting that rapidly rising inflation on the back of the fuel subsidy removal and the liberalisation of the exchange rate will reduce demand for imported consumer products and capital items over H2, 2023.

The organisation predicted that economic growth would accelerate modestly to 3.2 per cent in 2024 even as the removal of the fuel subsidy and the devaluation of the exchange rate would keep consumer price growth elevated, particularly in H1, 2024.

“Indeed, we project that inflation will average 23.4 per cent in 2024, continuing to put pressure on purchasing power. However, weak domestic consumption and the start-up of the Dangote refinery will also ensure that import growth will remain in contractionary territory.

“Our oil & gas team expects that production at the new refinery – which was commissioned in May 2023 – will start in Q4, 2023, reducing the need for imported fuel (Nigeria’s largest import product) through 2024.

“With oil production – and thus exports – continuing to expand in 2024 on a more secure and rehabilitated midstream network, exports will continue to outpace imports, providing tailwinds to growth,” the firm stated.

Looking beyond 2024, Fitch said it believed that economic reforms and the start-up of the Dangote refinery would improve economic conditions.

A more liberal exchange rate regime and a lower dependence on imported fuel, it said, would ease foreign currency shortages, improve business sentiment and result in a gradual return of international investors to Nigeria.

“This will lead to stronger fixed capital formation and more employment opportunities, supporting private consumption. In addition, improving public finances should allow the government to increase expenditure on growth-generating investment projects.

“While downside risks to our long-term views are substantial, these dynamics have led us to increase our 2023-2032 average growth forecast to 4.2 per cent from our previous projection of 3.6 per cent,” Fitch stated.

Report: How World Bank, States Built National Social Register

The National Social Register used by the administration of former President Muhammadu Buhari for its conditional cash transfer was an aggregate of all states’ social registries from the 36 States of the Federation and the Federal Capital Territory, according to a World Bank, empowered Newswire reports.

This was contrary to reports emanating from the last National Economic Council (NEC) meeting suggesting that the register was a top -down database from the federal government and questioning its credibility.

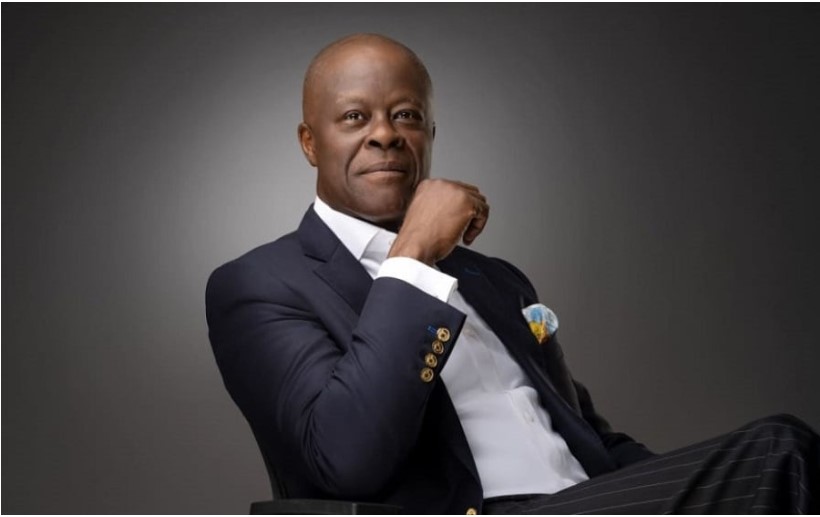

It revealed that in a presentation to NEC last Thursday, by the Nigeria Country Director of the World Bank, Mr. Shubham Chaudhuri, indicated that in developing what became the National Social Register, each State Governor through their Budget and Planning Ministries built up the registries and merely forwarded same to the federal government who then adopted it for its National Social Investment Programmes, particularly the Conditional Cash Transfers.

In the presentation of the World Bank last week to NEC, the Country Director stated that in the development of the State Registers, there were three stages: geographical selection, community based selection and Enumeration/Data Processing & Storage.

Under geographical selection LGAs, wards communities were prioritised based on levels of poverty and vulnerability.

According to Chaudhuri’s presentation “two approaches were employed: using poverty headcount and using high resolution poverty maps based on satellite imagery. A multi-sectoral team at the LGA level was involved in the ranking exercise.”

He added that there was a community-based targeting team comprising state and LGA officials and households were visited by this officials and digital identification information collected where available.

Furthermore, when done, the data was stored “in the State Social Registry Database supported through a management information system managed by a State Operations Coordinating Office,” set up by the state governors themselves.

In fact, World Bank and federal government sources also revealed that the bank was fully involved in the process of developing the Registers state by state and also funded the enumerators who were appointed by the state governors. “The whole process had started during the Jonathan Administration when 8 States were already developing the Register with the technical assistance of the World Bank, and the rest of the States came on board during the Buhari Administration.”

It further quoted World Bank sources to have further asserted that several of the states have also been using the Registries for different state-based schemes and local initiatives since, wondering how the same NEC to whom the Country Director made the 25 slides presentation concluded that the National Social Register lacked integrity.

“As we speak several States Governments are using the Registries up till now,” World Bank, FG NSIP and disclosed. The sources explained that, “prior to June 2015, the development of the Social Register was a contractual process that involved the direct engagement of the States Governments with the World Bank.”

It was added that, “when the new Buhari Administration then adopted the idea as part of its National Social Investment Programme, the World Bank working with the State and Federal Governments, provided the Guidelines utilised in making the Register a National database. The World Bank’s guidelines firmly provided a community-based approach, in accordance with international best practices.”

Chaudhuri, had told THISDAY in an interview earlier this year, that the National Social Safety Net Programme was part of the support for Nigeria’s vision for establishing a social protection system.

He had said: “This was spearheaded by the Vice President, Prof. Yemi Osinbajo and the idea being that like more and more developing countries around the world and even here in Africa –Ethiopia, Kenya, etc, the government needs to have a programme that can do two things – Help people who are poor climb out of poverty.

“Many NGOs were involved in the process and it was a bottom-up process as communities were asked to identify the most vulnerable among them. Now that register has over 16 million households nationwide and it is maintained by the National Social Safety Coordination Office (NASSCO).

“There were some conditions attached. It was agreed that all payments had to be digital, either through a bank account or mobile wallet and that it must not be catch. Everything was to be identified biometrically either through BVN or National Identity Number.”

(ThisDay)