Senate passes MTEF, sets to probe tax waivers under Buhari

The Senate has resolved to probe all tax waivers by the Federal Government from 2015 to date, just as it sought cancellation of those not directly linked to non-governmental or non-profit organisations.

The Senate also ordered the deregistration of all subsidiaries to the Nigeria Postal Service, being irregular and illegal identities and called for an investigation of the N10bn released by the Ministry of Finance for the proposed NIPOST restructuring and recapitalisation.

The Upper legislative Chamber also sought stiff punishments, including jail terms for violators, of finance laws.

The Senate resolved on Wednesday during the passage of the 2024-2026 Medium Term Expenditure Framework and Fiscal Strategy Paper.

The passage of the executive communication followed its consideration and adoption of the report of the Ad Hoc Committee set up for the purpose.

The passage of the MTEF/FSP followed the consideration and adoption of the Senate Joint Committees on Finance, Appropriations, National Planning and Economic Affairs and Local and Foreign Debts on the 2024-2026 Medium Term Expenditure Framework and Fiscal Strategy Paper.

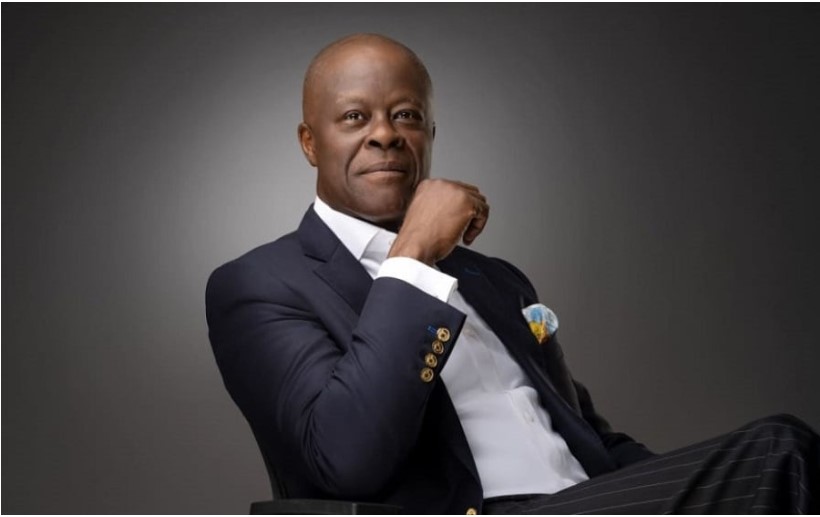

The report was presented by the Chairman Senate Committee on Finance and Chairman of the Joint Committee, Senator Sani Musa.

It approved the new borrowings of N7.8tn, pegged the benchmark oil price for 2024 at $73.96 and oil production volume per day at 1.78 million barrels.

Other parameters approved were a GDP growth rate of 3.76 per cent, an inflation rate of 21.40 per cent, a suggested benchmark exchange rate of N700 to $1 and a projected budget deficit of N9.04tn.

The report added, “FGN recommended spending N26tn with N16.9tn as retained revenue.

“N9tn budget deficit (including GOEs), N7.8tn in new borrowings (including borrowing from foreign and domestic sources).

“N1.3tn worth of statutory transfers, an estimated N8.2tn in debt service, N234.6bn in the sinking fund, N1.27tn in pension, gratuity and retiree benefits.

“Total recurrent (non-debt) of N10.2tn and N4.49tn as capital expenditure .”

That the Federal Government’s target-setting approach and its determination to enhance the major revenue-generating agencies’ collection efficiency will support the fiscal deficit estimate of N9tn (including GOEs) is noted and hereby approved.

“That the Federal Government should continue to enforce the implementation of the Performance Management Framework for GOEs by ensuring that they operate in a more fiscally responsible manner while reviewing their operational efficiencies and declared costs-to-income ratios;

“That the N7.8tn in new borrowings (both domestic and foreign) be supported as well, given the country’s current effective debt management strategy, which has moderated borrowing costs and decreased the amount of short-term debt in the portfolio and refinancing risk.

“That the National Assembly begin the process of amending the Fiscal

Responsibility Act (FRA, 2007) to enhance the agencies’ ability to enforce fiscal responsibility and impose sanctions on erring Corporations.

“Specifically, with regard to Sections 21 (1) and 22 (1)(2);

The National Assembly Standing Committees take prompt action to review the laws governing the activities of all revenue-generating agencies under their purview in order to identify specific sections or clauses that need to be amended in order to plug waste and increase the government’s capacity to generate revenue.

“That the Federal Government Agencies ensure deployment of ICT in the collection of all revenues by MDAs including stamp duty collection activities in order to block leakages.

“That the Budget Office of the Federation and the Ministry of Finance Budget, and National Planning re-evaluate the underlying assumptions for all Federal Government agencies’ income targets in order to confirm the veracity of those assumptions and the effects;

“The Federal Government should continuously assess the qualifications and performance of agency heads to guarantee that the government’s total income target as stated in the MTEF/FSP and the yearly budgets are consistently met with adequate sanction where necessary.

“That all Ministries, Departments, and Agencies pay for services provided by other government agencies on time and in full unless it is determined that the beneficiary agencies are statutorily exempt from such payments.

“That Ministry of Finance Incorporated examines the activities of all Government Agencies currently operating under the partial and full commercialization arrangement allowing them to compete with their

peers in the private sector, thereby making a more meaningful contribution to the Federal Government’s revenue generation drive.

“That the Bureau of Public Enterprises Act be amended to remove the clause(s) that create conflict between BPE and MOFI where MOFI should be the authorized custodian of all Federal government assets, both liquid and physical.

“That the Nigeria National Petroleum Corporation Limited should work towards reducing its cost of production and operational costs with the view of increasing available government revenue.”

(Punch)

Join our new WhatsApp community! Click this link to receive your daily dose of NEWS FLASH content. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like.