Why new naira notes are scarce – CBN sources

There seems to be no end in sight to the scarcity of the redesigned naira notes as officials of the Central Bank of Nigeria (CBN) blame the general public for the problem.

The apex bank commenced the circulation of the new notes on December 15 last year, but four months after, two of which majority of Nigerians spent in severe suffering occasioned by the scarcity, the new notes are hardly seen by the people who are supposed to spend them.

An investigation conducted by The Nation during the week revealed that about 80 per cent of the naira notes being spent by Nigerians now are the old notes.

And that was even made possible by the Supreme Court which, in a landmark ruling on March 3, extended the validity of the old N200, N500 and N1000 notes till December 31, 2023.

A seven-member panel of the court led by John Okoro ruled that the old notes should circulate alongside the new notes until the end of the year.

It took the CBN about two weeks to act on the judgment.

Bank customers across the country said much of the money they have been receiving at banking halls and from ATMs are the old notes.

Traders and transporters also say customers hardly pay them with the new notes.

Bank officials told our correspondents that they disburse what they receive from the CBN.

They said the new notes hardly come their way.

A Lagos-based entrepreneur, Mary Okon, said all the cash receipts for goods sold came in old naira notes.

“All the cash I received for goods sold were in old notes. Sometimes, I wonder where the new notes are. This has affected our turnover, worsened cash crunch crisis and made payment for goods very cumbersome,” she said.

Another bank customer, Michael Otu, said the low cash position in many families has made it difficult for them to buy things that are needed like food, clothing and provision, among others.

“We have seen many families cut their expenditure because of low cash positions. We hope that the situation will improve when the CBN releases more new notes into the economy,” he said.

In many of the bank’s branches visited in Victoria Island, Matori, and Ikeja axis of Lagos, there were still queues of customers wanting to make cash withdrawals with the N20,000 weekly limit.

The banks’ Automated Teller Machines (ATMs), which dispensed new notes at the time the new notes were launched, have returned to old notes disbursement across the counter or through other payment channels.

Officials of the CBN who do not wish to be named because they are not authorised to speak to the press on the issue alleged that many Nigerians are hoarding the new naira notes ahead of the December deadline for the phasing out of the old notes.

A source at the CBN said: “About N1 trillion is currently in circulation and more money is being printed and released.”

The source, who is involved in key monetary policy decisions of the apex bank, added: “People, not only politicians but ordinary Nigerians, are hoarding the new notes because of uncertainties.

“You know December will soon come. That is when all the old notes will cease to be legal tender. So people are stocking the new notes to mitigate uncertainties over the old or new naira notes.”

The CBN official advised the “authorities to engage in massive enlightenment and reassurances that the new notes will be available in and after December.”

According to the official, the CBN “releases N70 billion to the banks to distribute to their various branches every day, and they are largely old notes by way of strategy because of the phenomenon I spoke to you about earlier.

“When people see the new notes they just take them out of the system and don’t bring them back.

“That is the reason the CBN is dishing out the old notes so that they become available and citizens can make transactions very easily. That is the current position.

“So, it’s not that the CBN is not releasing money at all.”

When told that Nigerians want the new notes, the CBN official said: “Why are people looking for the new notes if they want to buy goods and services and money is available?

“They should leave that strategy to the CBN. That’s the bank’s problem, because by the end of the year, all the old notes being released now will also be removed from the system.

“For now that is not the problem of the citizens.

“Those complaining are looking for the new notes to hoard. That’s the implication.”

What is happening, the source said, “is that the new notes are not returned to the commercial banks.

“If they can be returning them to the commercial banks, the banks will also give them out to the citizens to use, but it appears that that is not happening,

“I don’t know what the fancy is in the new notes that they are hoarding them again.”

The official also disclosed that the CBN will print more new notes between now and December.

“Definitely it (CBN) will, because the old notes would have to exit the system.

“But for now, the strategy of the CBN is to meet the present exigencies, ameliorate any suffering, make money available, either old or new, so that people can have easy access.

“But the CBN has its own strategy to ease out the old notes before the end of December, so the implication is that there is the likelihood that more new notes will come into circulation.”

The official sought to allay fears that printing more new notes to maintain the N1trillion in circulation will lead to excess liquidity.

His words: “The CBN will map out appropriate strategies. New notes printed will replace old notes that will be eased out.

“There is no likelihood of too much currency in circulation, and secondly, the bank has its own idea of the optimal quantity of cash or notes, both old and new, that should be in the system. That is what the CBN is working towards.”

One of the reasons the initial attempt at currency redesign failed was the unavailability of smaller denominations of N100 and N200 notes for ordinary citizens to spend.

Admitting that that was a lapse in judgment on the part of the CBN, the official said: “I envisaged that one. Some of us have also made that point, because printing of the lower denomination notes will reduce the prospects of hoarding and counterfeiting of large denomination notes.

“That will help to meet the objectives of the CBN to minimise hoarding and counterfeiting of large notes.

“You know it is the large denomination notes that are very vulnerable to counterfeiting because of the huge profit they make from it.

“So the possibility is there that the CBN will print more of the lower denominations in line with its own objective.”

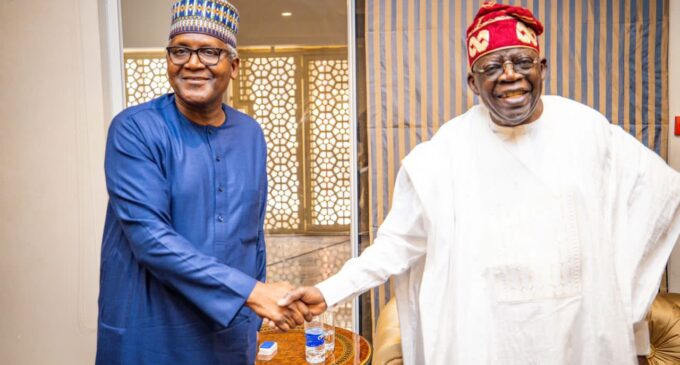

A member of the Presidential Economic Advisory Council, Bismarck Rewane, said the CBN printed approximately N400 billion new naira notes following the currency redesign programme.

In a report titled: Nigeria Hits A Brick Wall, Rewane said that a shortfall of N2.48 trillion cash exists, leading to near paralysis of commercial activities in the economy.

He said the shortfall represents 90 per cent of the cash in circulation, meaning that only about 10 per cent of the cash needed was printed.

According to Rewane, an economist and Managing Director, Financial Derivatives Company Limited, three of the eight naira denominations – N200, N500 and N1,000 estimated at N2.88 trillion – make up 90 per cent of the total cash in circulation.

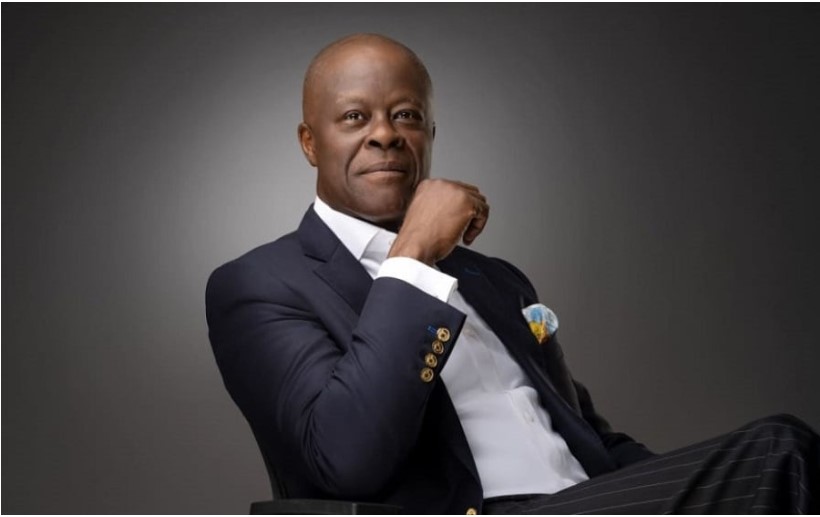

Also speaking on the development, an economist and CEO, Economic Associates, Dr. Ayo Teriba explained what is playing out.

He said a breakdown of the N400 billion new notes printed by MINT Nigeria showed that about 700 million pieces of new notes are in circulation at present.

He said the volume of the new notes, falls drastically below the 9.75 billion pieces naira notes circulating before naira reforms.

He said: “The Naira notes have attracted global attention at the turn of 2023 for the wrong reasons.

“The currency redesign policy was a needless exercise that turned out to be a chaotic wild goose chase until the Supreme Court suspended it on legal grounds.

Advertisement

“The Supreme Court Ruling has however not completely taken the issue off the table as the N200, N500, and N1,000 currency notes may still cease to be legal tender by 31 December 2023.

“The policy choice Nigeria must make is whether to replace the old notes with new ones of the same face values or with new notes of larger face values.”

He suggested that instead of wasting resources to print and replace 9.75 billion pieces of naira notes, it can be drastically reduced by introducing larger denominations notes.

Teriba said it is very unlikely that the CBN will print over nine billion pieces of new notes to totally replace the old notes by December 31.

He suggested: “The pieces of Naira notes in circulation had exploded to 9.75 billion pieces by December 2021.

“This piece demonstrates that the introduction of N2,000, N5,000, N10,000, and N20,000 notes that would be equivalent to US$4 to US$50 now is the sensible way to drastically reduce the pieces of Naira notes in circulation to between half a billion and a billion pieces before the end of 2023.”

He said that at less than US$1 per Naira note, Nigeria has inadvertently printed far too many pieces of these small value notes to be easily manageable by CBN.

The reason the CBN could never have printed enough of the N200, N500, and N1,000 new notes was that there were well over five billion pieces of them in circulation, and there was no way the CBN could have printed that much even if they had two years to do so.

Advertisement

Teriba said the nominal value of currency in circulation is the most basic measure of cash circulating in the economy, a key component of the overall money supply that lubricates economic transactions.

According to him, the total value of cash is only meaningful when related to the economic transactions that it is meant to lubricate. As such, you cannot conclude that it is too much or growing too fast by looking at its size or growth in isolation.

Teriba said Nigeria fell into that trap in the nineties as the total pieces of naira notes in circulation was to rise steadily from 1.5 billion pieces just after the N50 note was introduced in 1991 to 8.5 billion pieces by year 2000.

But an industry source said the new notes are scarce because of currency hoarding. According to the source, the new naira notes released by the CBN are being hoarded by high net-worth customers of banks, who had unlimited access to the cash.

The source said many high net-worth individuals who were able to source the new notes stockpiled them thereby depriving the public from having access to the cash.

President, Bank Customers Association of Nigeria (BCAN), Dr. Uju Ogubunka, said it was very worrisome that the new notes are not available to the ordinary people on the streets.

“You can occasionally see the new notes with politicians and top business executives who maintain huge account balances in banks.

“We have read stories of banks calling their top customers to come and take new notes. If third party intervention is needed for MINT Nigeria to print the notes, let them request for such support,” he suggested.

Ogubunka, a former Register/Chief Executive Officer, Chartered Institute of Bankers of Nigeria (CIBN) said the Domestic Operations at the CBN owes Nigeria explanations on what is keeping the new notes out of reach of the people.

“I know that a lot of security measures are involved in new notes printing. But whatever it is, by now, the old notes should be passing out. But what we have is that the old notes have remained the dominant means of transaction.

Advertisement

“If care is not taken, we will have another round of crises by December 31 when the old notes will cease to be a legal tender,” he said.

At a press conference in Lagos, CBN Governor Godwin Emefiele had admitted the hiccups in the implementation of the policy.

Emefiele said the apex bank was addressing “pressure areas” by redeploying cash where there are excesses. The governor described the challenges as transient, promising that the issues would be overcome soon. He urged Nigerians to embrace alternative payment channels.

On the scarcity, he said: “CBN is aware of the difficulty being faced by Nigerians in accessing the new currency at this initial stage of its issue and circulation but wishes to plead with all to please show some understanding as everything is being done to correct some of the observed lapses in the implementation of this ambitious programme.”

The Nation